A Primer on the Psychology of Risky Decision Making

Prospect Theory

Standard economic models assume that people are expected-utility maximizers. In other words, they evaluate risky prospects by weighing payoffs by their probabilities, and then choose the option that yields the highest expected utility.

A simple set of choice problems reveals behavior that is incompatible with expected utility theory. Using similar problems, Daniel Kahneman and Amos Tversky discovered that people often overweight small probabilities, underweight large ones, and are loss averse. They incorporated these patterns into a much more fitting descriptive model—prospect theory.

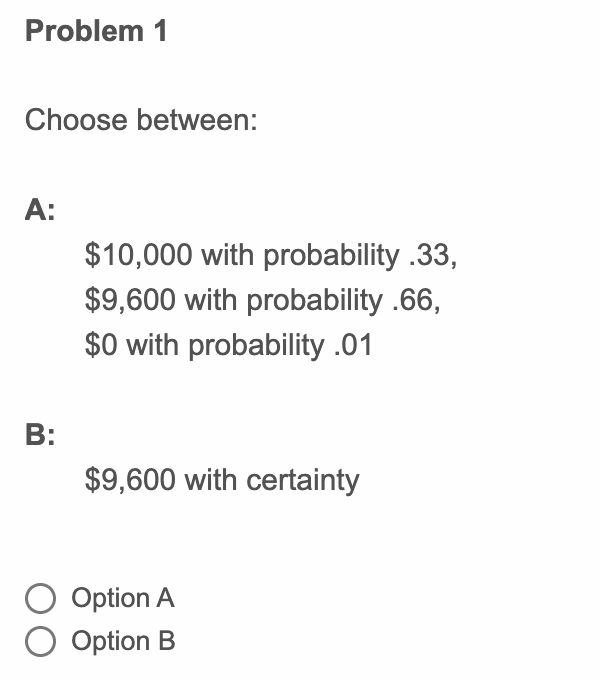

58% of participants in our sample choose Option B in the first problem while selecting Option A in the second. However, the second problem is identical to the first, with the only difference being that $9,600 with probability .66 is subtracted from both options. If you say you prefer Coke to Dr. Pepper, it would be a tad strange to say you’d rather have Dr. Pepper and $5 than Coke and $5, wouldn’t it?

Now you try. Consider the problem below. Which option would you choose?

Note down your answer, then consider the following problem. Which option do you prefer?

64% of our subjects choose Option A in Problem 4, while 78% choose the guaranteed $12,000 in Problem 10. Are you among the 49% of participants who made both of these choices? What if we told you that the choices in these two questions are equivalent in terms of final outcomes? Multiply the probabilities in Problem 10 by the probability that the choice stage is reached (75%) and see for yourself!

Here is another pair of problems.

Expected utility theory suggests that people integrate prospects with their current wealth. But that doesn’t seem to be the case: although these two options are equivalent in terms of their final outcomes, i.e.,

Option A (in both problems) = ($2,000, .25; $1,000, .75)

Option B (in both problems) = ($1,250)

35% of subjects choose Option B in Problem 11 and Option A in Problem 12. So, rather than depending on integrated wealth, as EUT suggests, people’s utility appears to be a function of changes in wealth. When it comes to gains, they tend to be risk-averse, while losses trigger more risk-seeking choices.